not financial advice!

Really happy to have you here today! I love talking about Ethereum. But before you jump in, this post is part of 3 post series (A trilogy - not like lord of the rings but still equally exciting.)

This is the last post of the “Should I buy Ethereum” series. You can read the last two posts below.I highly recommend reading these first to fully understand the whole concept. ( yes! I also made a youtube video.)

Part 1: Should I Buy Ethereum? Why Ethereum is a Good Investment

Part 2: Should I Buy Ethereum? 7 Reasons Why Ethereum is a good investment

Part 3: This post right here! Continue reading : )

Since Ethereum 2.0 is just around the corner, I want you to be ready for when it finally arrives in 2020. The most exciting and revolutionary improvement that Serenity Ethereum 2.0 introduces is proof-of-stake or PoS for short.

In this post, you will learn everything you need to know about the benefits of proof-of-stake and how you can earn money by staking ethereum.

What is Staking? Basically A better way to mine: Uses less hardware and less electricity.

Staking is very similar to mining which is being used in Ethereum 1.0 the Ethereum we have today. If you don’t know what staking is - don’t worry! I also didn’t know at first. To be honest every time I hear the word staking it reminds me of buffy the vampire slayer series I watched as a teen.

I’ll try to explain in detail what proof-of-stake is later on in the article - spoiler alert: it has nothing to do with buffy. The short answer is: staking is the process of holding funds to receive rewards, while contributing to the operations of a blockchain.

The important part here is by locking up your Ethereum you will earn interest as Ethereum (ETH) in return. You can picture it like a stock that you buy for which you get some yearly dividends. Pretty awesome right? Yes it is.

Now you might be wondering why will Ethereum use staking and stop using proof of work? Well, staking brings a lot of advantages to the Ethereum blockchain.

First and foremost staking is a lot more energy-efficient than mining - Greta Thunberg approves! /jk

Furthermore, it will address the burning issue of scalability and reduce Ethereum’s inflation rates. To sum it up staking is in general more secure and leads to a higher decentralization and scalability than mining.

These changes are pretty big for the Ethereum blockchain and the decentralized application running on it.

How will Ethereum move from Proof-of-work to Proof-of-stake?

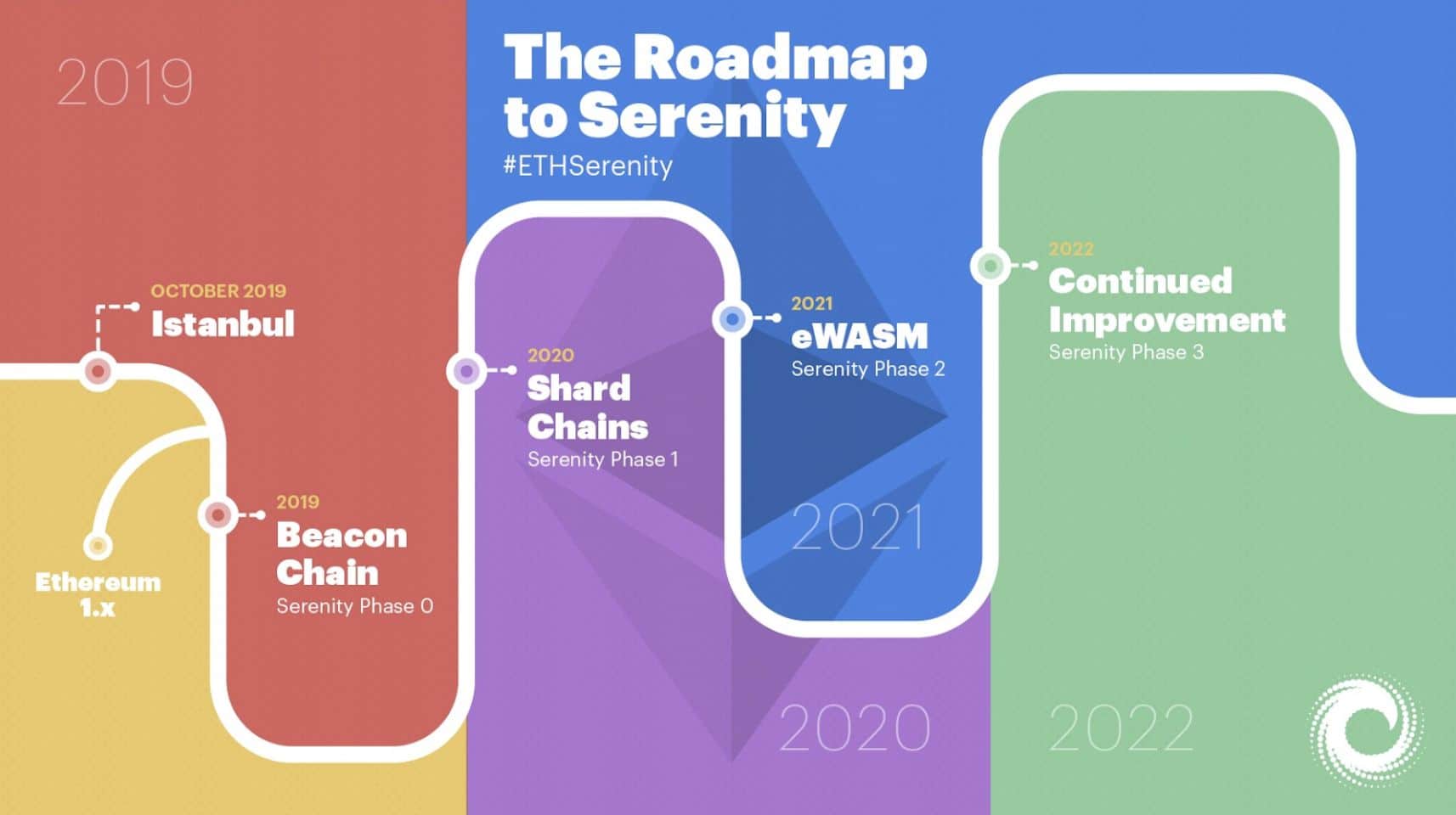

A very good question. This transformation, in technical terms consensus protocol switch, will happen with a larger set of upgrades known under the alias Serenity - Ethereum 2.0

However, Serenity brings a lot more changes than just a switch from PoW to PoS. Ethereum’s core the Ethereum Virtual Engine EVM will be replaced by eWASM, which has some quantum-proofing attributes. Furthermore, there will be some improvements to improve the survivability of the network (protection against quantum computers.)

Ethereum staking is just the first step of the Serenity upgrade.

It all starts with the new Casper PoS protocol which is launched on a parallel Beacon Chain. Casper addresses many issues such as increasing scalability and removing centralisation caused by the current PoW protocol.

In the current PoW protocol only a few large mining pools are responsible for the majority of the hashing power. This causes a lot of problems as it increases the chances of a 51% attack. This is also a recurring problem with other PoW blockchains.

The Serenity Phases

As port of the Serenity upgrade and Ethereum 2.0 - the upgrades have been split into different phases. Specifications for Phase 1 are complete but information around Phase 2 is still subject to change.

- Phase 0 - launch of the beacon chain. Is the core of Ethereum 2.0. This manages the validators and the coordination of shards.

- Phase 1 - sharding is introduced which brings big scalability improvements.

- Phase 2 - Ethereum 2.0 is finally upgraded and has become a fully decentralised computing platform with smart contract and transactions capability. eWASM is also added.

What exactly is Proof of Work - A quick explanation

In the current PoW protocol only a few large mining pools are responsible for the majority of the hashing power which causes a lot of problems as it increases the chances of a 51% attack.

The Ethereum network is secured through a process called mining. Miners solve complex calculations, which can be compared to hard sudoku puzzles. They need a lot of computer power to solve these puzzles. However, when a miner manages to solve one of these puzzles (a block) the proof of their “work” is stored on the blockchain. Miners race each other to compute the next block. The first miner to solve the next block receives newly minted Ether (ETH) as a reward as well as transaction fees for that block. If you want to learn more about mining I posted a video a while ago explaining What is Bitcoin mining in 5 minutes.

The security of the Ethereum network relies upon the amount of computing power, also known as hashrate, which powers the network. Since mining requires a lot of computing power, there are a lot of miners on the network. This is to prevent a person or a group of people from having more than 2/3s of the hashrate and to prevent a 51% attack. However, with mining farms getting bigger, the computing power is no longer as decentralised as we would like it to be.

This is where Proof of stake comes in and why moving to proof-of-stake is a sensible decision.

Proof of Work vs Proof of Stake

Proof of Stake is Ethereum’s solution to become a more efficient and secure network. As an investor you won’t need to go through the steps of purchasing expensive mining hardware when becoming a validator on ethereum 2.0.

The only investment you will need to make is to buy 32 ETH which will be locked away. This is a security to ensure that the validators are good and not corrupt. You can compare this to a sum of money you would put away when renting a place as a security. As a validator you will be able to earn rewards from validating blocks.

However, if your validator is offline for too long, is somehow inaccurate or you try to cheat the system then there are disincentives in place which will eat away at the 32 Ether that you locked away. This is the same as when you are renting a place and something gets damaged, then that sum gets taken out of the security deposit.

Proof of Stake is a way to effectively increase the security of the network from the inside instead of relying on costly hardware and electricity. You can now see why it is a lot harder to perform a 51% attack on Ethereum when it is using Proof of Stake. A bad actor would need to own a considerable amount of ETH to perform this attack. Even with a lot of ETH to attack the network the bad actor would be only hurting himself and costing a lot of money by attacking the network.

When is Ethereum switching to Proof of Stake?

Serenity is a massive project! And i’m super excited.

This is one reason why I believe that Ethereum is a good investment.

Ethereum 2.0 will roll out in phases. With Phase 0 already rolling out in early 2020. However, we need to be patient, Ethereum 2.0 won’t we able to take over all the functions of the original Ethereum until Phase 2.

Phase 0 marks the launch of the Beacon chain which is the first step for Ethereum 2.0. The Beacon chain will run side by side Ethereum 1.0 chain.

With Phase 0 investors can already start staking their Ethereum by becoming a validator the process of validating blocks in a Proof of Stake network begins.

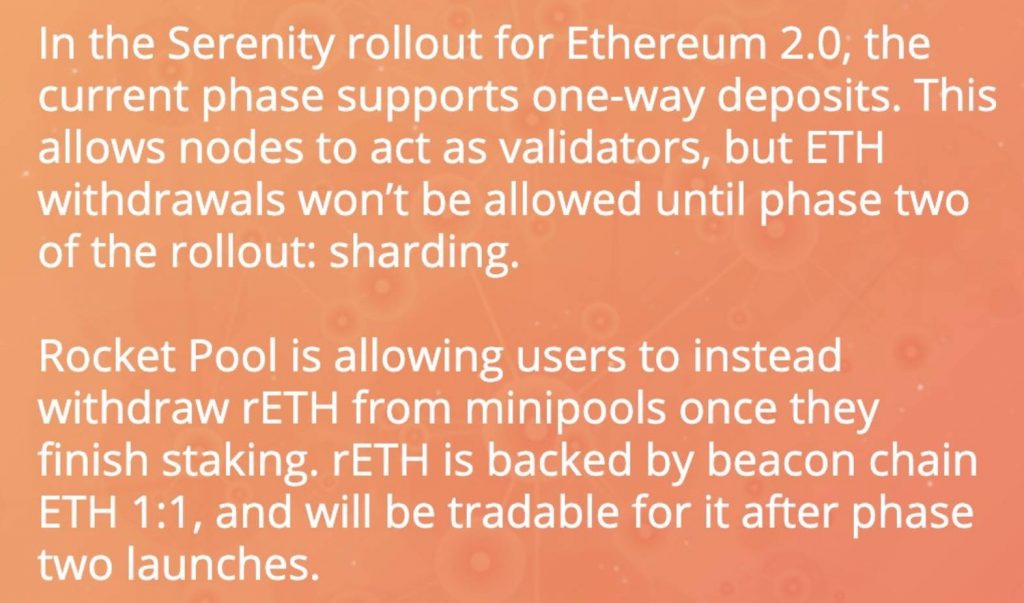

It is important to note, that investors locking away their 32 Ethereum 1 (The Ethereum we have now) will need to wait until Phase 2 to unlock their Ethereum. You can picture this as putting your car in a garage but will only be allowed to open the door with the new key which will probably only be released in two years.

Basically after Phase 1 has introduced sharding and Phase 2 has enabled full state execution and the possibility of transfers and smart contracts.

Long story short. Only stake these 32 Ethereum if you truly believe in the project and are willing to wait for at least two years until Phase 2 of Serenity rolls out.

You can read more about the Ethereum 2.0 roadmap here.

Now for the important to answer the question “how can I start staking Ethereum to make passive income”

Now let’s answer some the following questions that get asked a lot

is Ethereum staking profitable? What is a ethereum staking pool?

How can I start staking Ethereum

Why would I want to stake Ethereum?

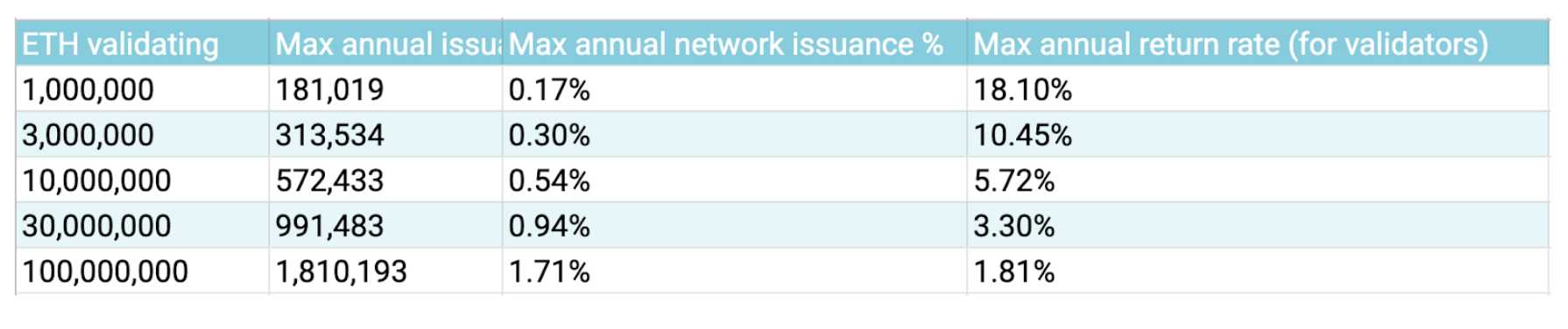

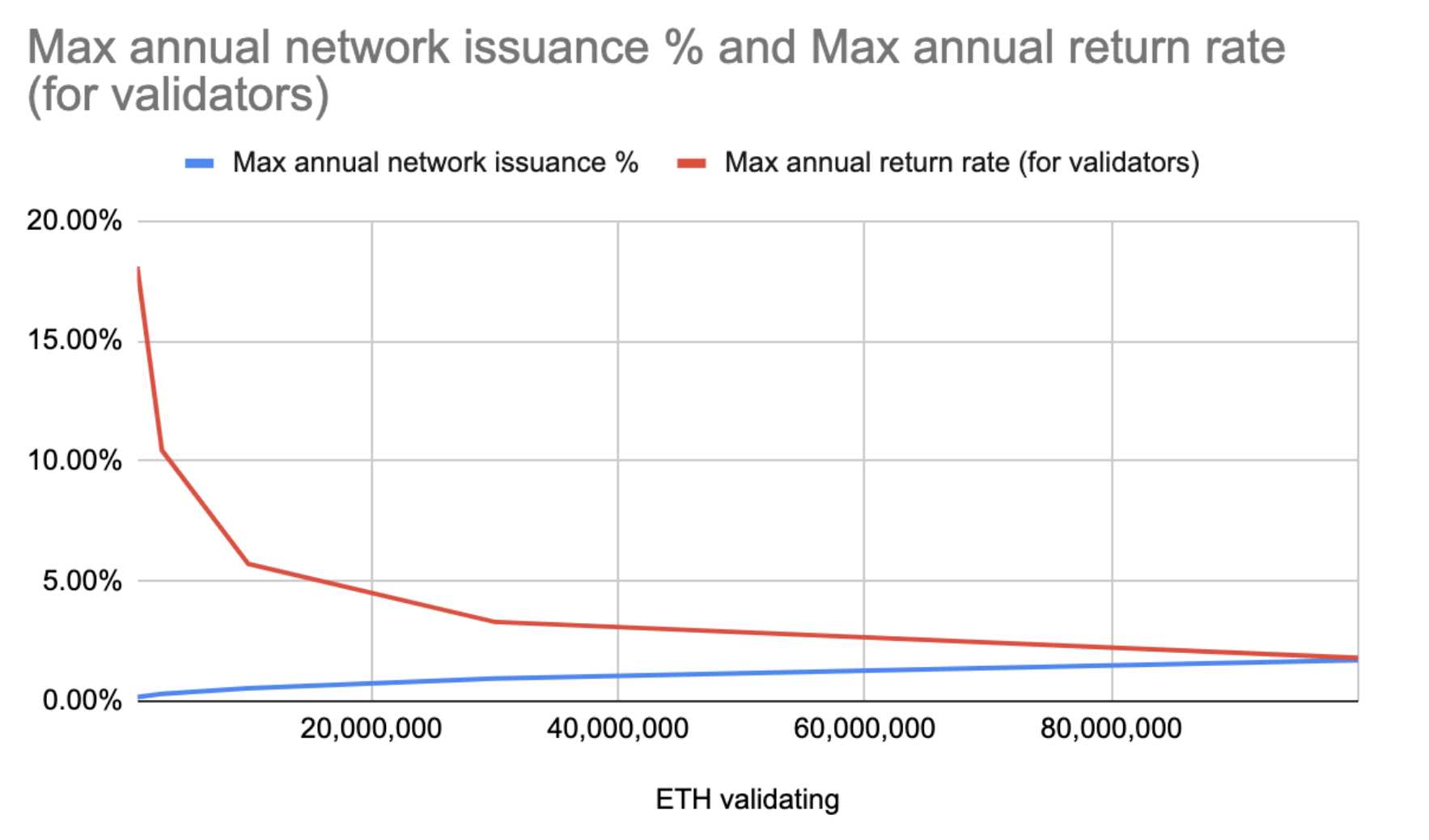

By staking Ethereum and verifying blocks you will receive an Ethereum reward. This additional is calculated by the amount of people staking at the same time.

How much do I earn staking Ethereum?

The reward you can get by staking Ethereum is between 1.8 and 18% per year. The general consensus is that the staking reward will be at 5% per year.

That means if you buy 32 ETH to USD is 4160$ (ETH = 130$ 23.12.2019) your return is: 208$ per year.

Current ETH price: [ccpw id=”2364″]

If you want to know more about how much Ethereum you can earn by staking. Then you can use this Ethereum staking rewards calculator.

What software do I need to stake Ethereum?

There are two different types of software you need to be aware of before you start staking on Ethereum

Beacon nodes: The hub for validators

Stores the canonical state, handles peers and propagates blocks

Validator Client: This basically talks to your beacon and signs blocks. You can have several validator clients, they just cost 32ETH each.

Therefore, you have three combinations of software you can run

- Beacon node

- Beacon node + validator client

- Beacon note + several validator clients

What are the hardware requirements to run this software?

This information still needs to be defined by the ethereum development team. As soon as I have more information I will update this post.

How long is my Ethereum be locked up when I stake?

If you lock up your 32 Ethereum in a validator Node with the Phase 0 upgrade, you will probably need to wait 2 years until phase 2 before you can withdraw your Ethereum. After the Phase 2 updgrade if there is no withdraw queue then the minimum waiting time is 18 hours. This adjusts depending on the amount of people wanting to withdraw their ethereum.

If you stake your Ethereum with a staking pool after the Phase 0 update then ETH is locked away until Phase 2. If you still want to withdraw then you will get a token called rETH which is backed by the ETH locked away. With Uniswap you can transfer this rETH back to ETH as long as the liquidity allows for that. You can read more about this rETH ETH bridge here.

Can I stake more than 32 Ethereum?

Yes you can stake more than 32 Ethereum. If you want to run your own validator client then you will need to run a validator client for each 32 Ethereum you want to stake.

Can I stake 320 Ethereum? If you want to stake 320 Ethereum you will need to run 10 validator clients on your computer.

Another option is to go with a staking pool. You can find more information about the staking pool below.

Can I stake Ethereum with less than 32 Ethereum?

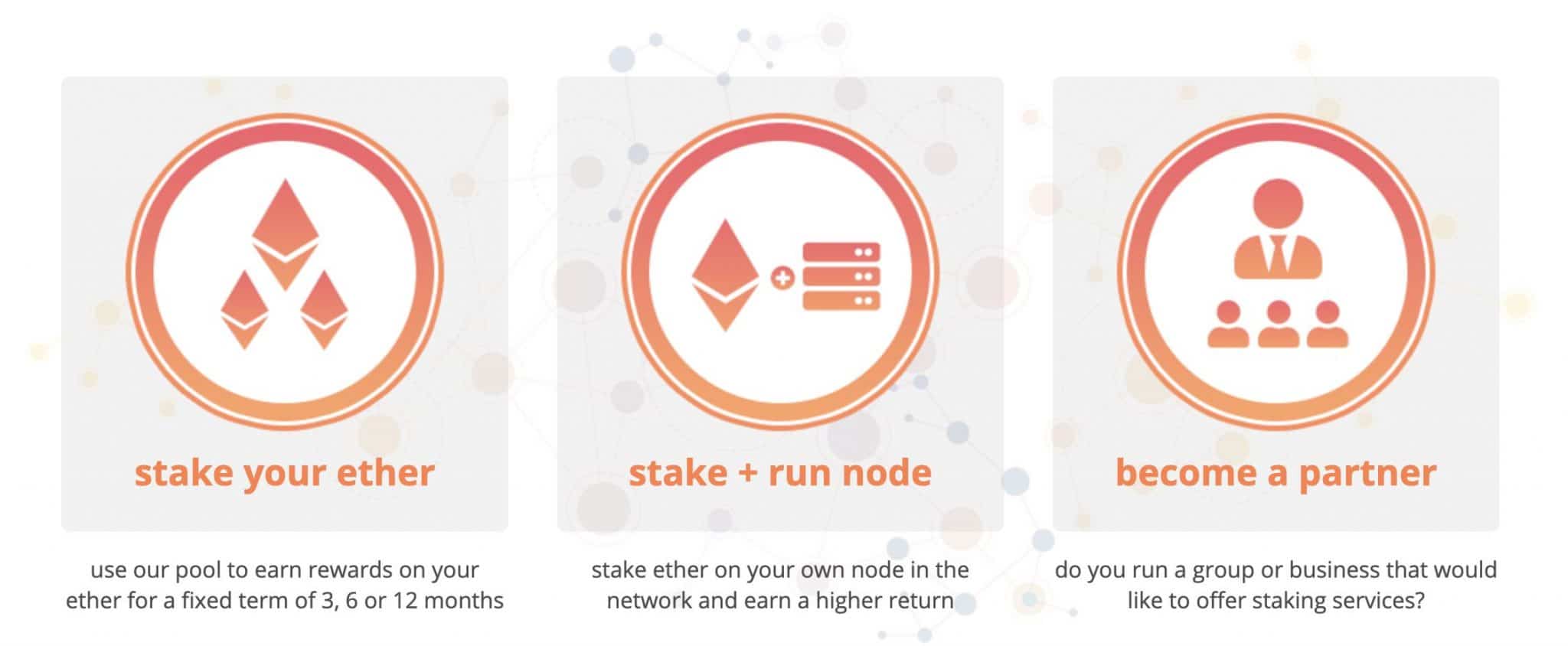

You will be able to stake as little as 1 Ethereum with a staking pool. An example of a staking pool for Ethereum is Rocket Pool they manage your stake or stake ether on your own node and earn a higher return.

The only downside with a staking pool is that they take a cut out of your staking rewards. I’m not sure how much yet. However, in my opinion that is fine, as long as the fee is low, as it removes all the hassle of setting everything up to become a validator.

How profitable is a staking pool? How much does a staking pool cost?

With rocket pool they try to be as competitive as it gets. They will only release numbers when people can start staking. You can read more here.

When can I start staking Ethereum with a staking pool?

You will need to wait for Phase 0 of Serenity, early 2020, before staking is active. Until then you will have to be patient.

To be honest with you, when I have the possibility I will probably go with a staking pool as I prefer passive income by staking ethereum instead of all the hard work setting up and running a validator.

There are several other companies such as Stake Capital, Staked, Stake.fish. Probably a few more will pop up in the next months. If this is something that interests you then put that in the comments below.

Conclusion - Should I buy Ethereum? Can I Earn money staking Ethereum?

In my opinion Ethereum staking is a BIG deal! I’m super excited about the whole Serenity upgrade. There definitely is a lot of risk involved, which is why the price of ethereum is still so low.

That’s probably another reason why Ethereum is a good investment.

This is the first time a Blockchain with such a big market capitalisation is attempting such a big transformation. Should Ethereum’s move to Proof of Stake be successful then it will mean a lot for the improvements in scalability and centralisation. It’s also setting a good precedent for other blockchains which might follow the lead.

In terms of staking and earning money with Ethereum - Me personally - I chose to go with a staking pool instead of with a validator. First of all I don’t have to lock up my Ethereum for 2+ years. On rocket pool you have options to lock up your Ethereum for 3, 6 and 12 months. This to me is ideal.

Hope you enjoyed this post. I will catch you on the next one : )