A stop-loss is already a great tool to make sure you don’t accidentally lose too much money while margin trading. That is why a healthy profit risk strategy is very important.

Watch the video below to see how to set a trailing stop Order in Bitfinex

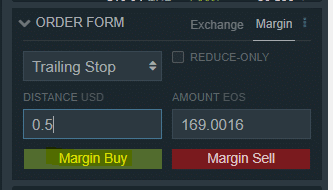

Setting A trailing stop order for Margin Long

When you are in a Margin Long position your trailing stop will be a sell order.

You set a sell order since you are selling the shares you bought at a lower price for a profit.

Setting A trailing stop order for Margin Short

When setting a trailing stop for a margin short position, your trailing stop will be a buy order.

You are buying back the shares that you sold. The difference between the high share price and the low share price is your profit.

In both examples we have set a distance of 0.50$

This means:

Margin long position

- If the price goes up from 14$ to 15$ the trailing stop moves from 13.5’$ to 14.50$

Margin short position

- If the price goes down from 15$ to 14$ the trailing stop moves from 15.50$ to 14.50$

I hope you enjoyed this tutorial.

Have a great day