Table of Contents

What is Nexus Protocol Terra

Nexus Protocol optimizes yields in the Terra ecosystem. Terra, as we know, aspires to bring DeFi to the masses. Nexus Protocol is like the missing piece of the puzzle for the Terra ecosystem because it helps retain the inflow of funds by providing maximum rewards to the Terra users.

Nexus is built by a team of community members who believe in the future of ‘programmable money. They work to unfold the utility such money will bring to the financial system.

The team has a special focus on prioritizing security in the Nexus Protocol while removing complexities in yield farming and providing optimum returns to its users. Nexus is made attractive due to its yield percentages, while Nexus’ added security measures eliminate anticipated risks. In their first product, Nexus focuses on ‘borrow strategies’ within the Terra ecosystem and is expected to scale up from there.

There is an interesting story behind the Nexus term ‘liquidation protector’.

Nexus Protocol was born as an idea during the May 2021 market crash. Unfortunately, LUNA was one of the tokens most affected during the collision. As the prices kept going down, bLUNA liquidations accelerated, causing a significant drop in LUNA prices. To the Nexus team, this demonstrated a problem in the programmable money concept that needs to be addressed. Therefore while providing attractive yields, Nexus also prioritizes securing its users’ funds from liquidation in market crash events.

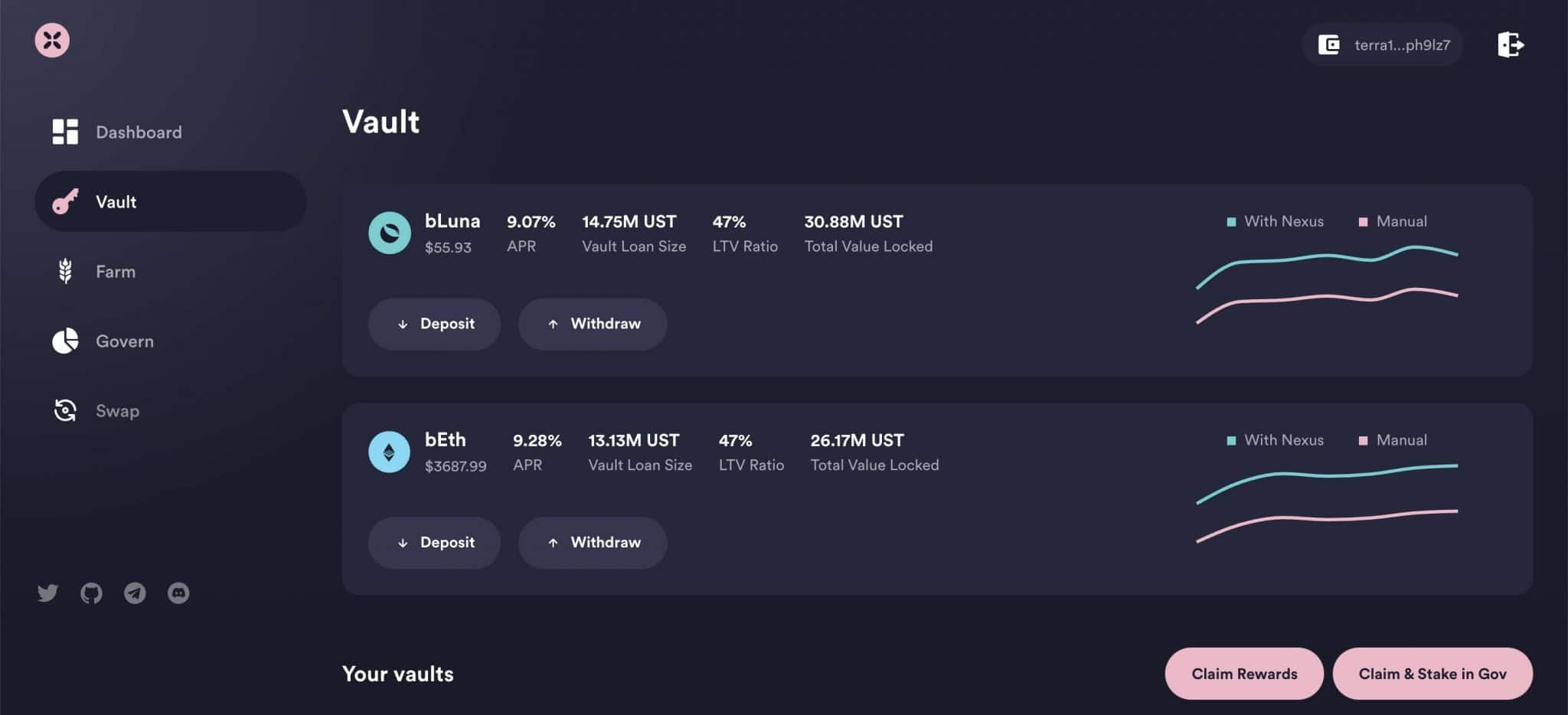

Nexus Protocol builds vaults for yield farming. Nexus currently has bLUNA Anchor vault (of which the specifics are discussed below) and aims to launch the UST vault in the future. Nexus intends to provide better rates than the Anchor deposit rate using the UST vault.

What blockchain is Nexus Protocol built on?

Nexus Protocol powers and is powered by the Terra public blockchain. As a payment platform for stablecoins, Terra facilitates users to spend, save, and exchange. Furthermore, Nexus empowers the blockchain by allowing users to earn optimum rewards for locking their money. In doing so, Terra distinguishes itself by placing the highest importance on protocol security and removing complexity for the users.

Why is Nexus Protocol excellent for terra LUNA holders?

Terra/ LUNA is one of the most loved tokens of this bull run and keeps seeing all-time highs (ATH) after every significant drop. LUNA is a governance token used to stabilize the price of the stablecoins in the Terra ecosystem. We will make it more straightforward if it is not apparent so far.

Nexus Protocol gives the token’s holders a direct advantage - you don’t have to rely solely on profits from selling your favorite token. Instead, you can hold it for longer and obtain rewards as you own it. This is because Nexus Protocol will allow you to maximize your yields from LUNA as Terra’s first yield optimizer.

A yield optimizer like Nexus Protocol with a particular focus on security paints a bullish picture for the Terra ecosystem. It incentivizes token holders to further hold on to their tokens and contribute to the Terra community. This, in turn, ensures sustainable growth for the Terra ecosystem and a continued increase in demand regardless of the market conditions.

What are Nexus Protocol Anchor vaults?

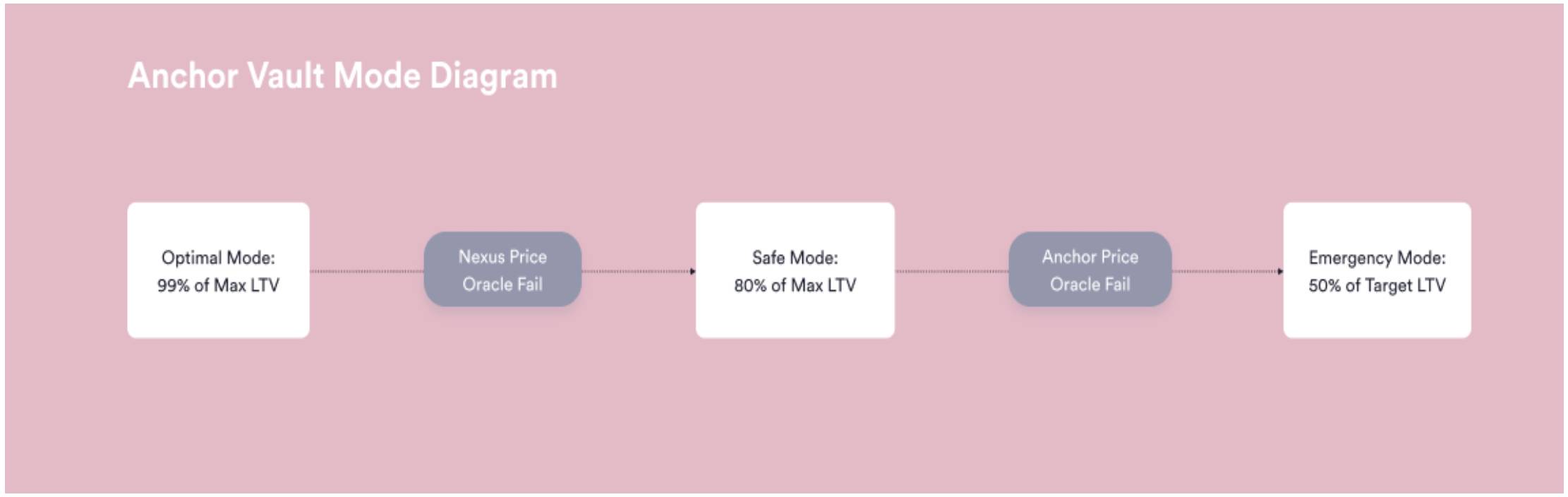

Nexus Protocol’s Anchor vaults allow users to deposit bonded assets like bETH (bonded ETH) and bLUNA (bonded LUNA) and earn optimized rewards from the Anchor borrow. As a security measure, the vault will have three modes - optimal mode, safe mode, and emergency mode, activated depending on the scenario.

The optimal mode will front-run Anchor Protocol’s price oracle.

On the other hand, safe mode will activate when Nexus price oracle fails. Nexus states that safe mode protects its users in dire market conditions as it is considered ‘the worst price crash for LUNA token to date’ in setting its parameters. Therefore, when normalcy returns, the optimal mode will activate once again.

The emergency mode will be automatically activated if the Anchor price oracle fails while on the safe way. The emergency mode will change the Loan to Value (LTV) management logic to decrease the target LTV.

In simpler terms, the optimal mode is the default setting for optimal rewards. However, the safety and emergency modes will get activated in extreme market conditions as and when necessary to protect the users’ funds in the vault.

Additionally, to deal with excess traffic and overwhelming transaction requests, Nexus deploys an independent node and works with several validators to ensure that the Protocol can push the necessary transactions for the vaults to function correctly.

What exactly is the bAsset vault?

bAsset vaults are Nexus vaults that allow users to deposit their bonded assets such as the bETH and bLUNA to earn rewards from Anchor Borrow. All such vaults deploy the three modes, namely optimal, safe, and emergency modes, to ensure two things: optimal returns to the users for their funds and safety of funds from being liquidated during extreme market crashes.

(Image source: https://docs.nexusprotocol.app/launch/protocol/bluna-vault)

How can you earn over 100% yield farming on Nexus Protocol?

As the Terra ecosystem’s first yield optimizer, Nexus Protocol offers impressive rewards for yield farming. You can enjoy the rewards in the following manner:

- Install the ‘Terra Station’ wallet (desktop and mobile available) and deposit your Terra tokens in the wallet. You can view the instructions and download the respective application from this link: https://docs.terra.money/Tutorials/Get-started/Terra-Station-desktop.html

- Go to https://terra.nexusprotocol.app/farm

- Connect your Terra Station wallet to the above site. Using the top right button, ‘Connect your wallet.’

- Choose the liquidity pool of your choice depending on your tokens, and provide the two tokens in equal proportion to start farming.

- Claim your rewards! You can unstake and withdraw your funds at any time.

Why is Nexus Protocol better than Anchor protocol?

Nexus’s vault’s optimal mode is designed to front-run Anchor Protocol’s price oracle. Nexus protocol deploys a more intelligent bot that uses the same oracle smart contract as the Anchor protocol to feed price data to the Terra blockchain but will feed price data every 15 seconds instead of Anchor Protocol’s 30 seconds. Due to this constant update in prices more often, Nexus Protocol can obtain ideal LTV levels, which will reflect the price changes. This outstanding loan to value ratio will, in turn, provide the optimum borrowing levels to the users and protect the assets locked by the users at the same time.

How does the Nexus Protocol safe mode work?

As explained earlier, the safe mode will switch reliance to Anchor Protocol’s price oracle when the Nexus price oracle fails. Therefore, the Nexus Protocol will not front-run Anchor Protocol prices in a safe way. The safe mode parameters will be activated to determine the LTV ratio. Having a safe mode and an alternative protocol price oracle is extremely useful to protect users’ funds in case of unexpected technical failures. Vault will switch to the default optimal mode once Nexus price oracle resumes working.

How secure is the Nexus Protocol?

A lot of thought and effort has made Nexus Protocol a secure platform for its users. Nexus involves third-party auditors and consultants to ensure its security. However, no protocol in the blockchain space is entirely free from risks of exploitation. The team acknowledges such risks in working on new technologies and encourages internal audits by the community. For this purpose, Nexus Protocol provides incentives in the form of bounties varying from $500 - $150,000 for discovering vulnerabilities.

What are Nexus Liquid Pylon Pool & Protocol-owned Assets?

Liquid Pylon Pools: The purpose of Pylon Pools is to provide more resources to the team to grow their Protocol while rewarding their users with an attractive yield. However, acknowledging the opportunity cost in keeping UST locked, Nexus proposes an intelligent solution called ‘Liquid Pylon Pools’ to overcome this drawback. According to this proposition, half of the funds from the Liquid Pool will be allocated to the Nexus community treasury. The funds earmarked can be converted to Protocol Owned Liquidity (PoL) at any point with a community vote.

Protocol Owned Liquidity: POL proposes that a project should acquire funds to support its development activities instead of enticing users to deposit their tokens for rewards. It is a fresh insight from DeFi developers aiming at sustainable growth strategies. The nexus team, too, has several goals to be deployed on PoL assets such as protocol buybacks, Pylon Pool, and a bond issuance program.

The users benefit from unlocking liquidity and making changes to yield strategies in real-time, enjoying arbitrage opportunities and reduced chance cost from the Liquidity Pylon Pool. At the same time, the team can be funded via the liquidity pool.