A company that wishes to get funding for their blockchain idea, publishes a DAICO contract. The DAICO contract starts in “contribution mode” which allow investors to contribute ETH to the contract and receive tokens in exchange. The parameters of the contract can be adjusted to meet the need of the company. (i.e capped sale, uncapped sale, dutch sale or an interactive coin offering. )

As soon as the contribution period ends, the tokens become tradeable, and the contract state changes. The most important part of what makes DAICO contracts important is the tap (units: wei /sec) counter. The counter is set to zero after the contribution ends. This parameter defines how much of the funds can be used by the development team by second.

Implemented into the contracts is a voting mechanism which allows investors/token holders to vote on resolutions. There are two types of resolutions:

- Increasing the tap rate

- Permanently self-destructing the contract and putting the contract into withdraw mode. All the remaining Ether is proportionally returned to the respective investors.

Like with most blockchain projects the goal is to decrease the amount of trust needed. This is why the DAICO approach gives investors a good amount of security and peace of mind back.

In the case of a malicious 51% attack on the votes, the developer can reverse the suggestion for the tap increase. On the other hand if the project owner decides to buy Lamborghinis instead of continuing the development of the project, the voters can decide to reduce the tap amount and as a final step also vote for withdrawal and delete the contract.

Any vote is subject to 51% attacks, bribe attacks and other game-theoretic vulnerabilities, and any ICO is subject to the risk that a team will be irresponsible or simply a plain fraud. However, in a DAICO these risks are minimized, requiring both the developer and the vote to be compromised to cause any real damage:

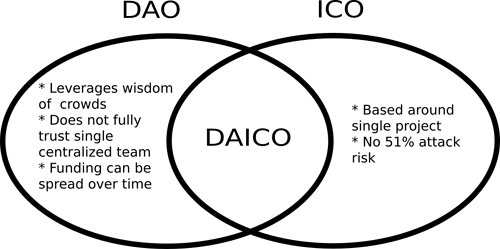

The graphic below is from the DAICO of ABYSS (ABYSS ICO using DAICO contract) and offers a good explanation of the benefits of DAICO and the disadvantages of an ICO. This is not a financial recommendation to invest in the following project.

Controversy around the topic

Controvery

The biggest controversy around the topic of DAICO is the DAO hack which you can read about here.

Immutable contracts are great when the code they are written is flawless. However, there are significant problems when a bug is noticed and no one can change the contract code. This was what happened during the infamous DAO hack at the beginning of May 2016. The security vulnerabilities that led to the hack just show how much damage can be done due to a small error in the code.